You know by now that socially responsible investing (SRI) does make a difference in the world, but perhaps you’re wondering what kind of difference it will make in your portfolio. Will you sacrifice financial returns if you align your investments with your values?

The evidence, amassed through hundreds of studies, shows that historically, SRI investments have performed as well as or better than their conventional counterparts.

A 2015 study from Harvard and University of Minnesota researchers found that consistently, “firms making investments on material ESG issues outperform their peers in the future in terms of risk-adjusted stock price performance, sales growth, and profitability margin growth.”

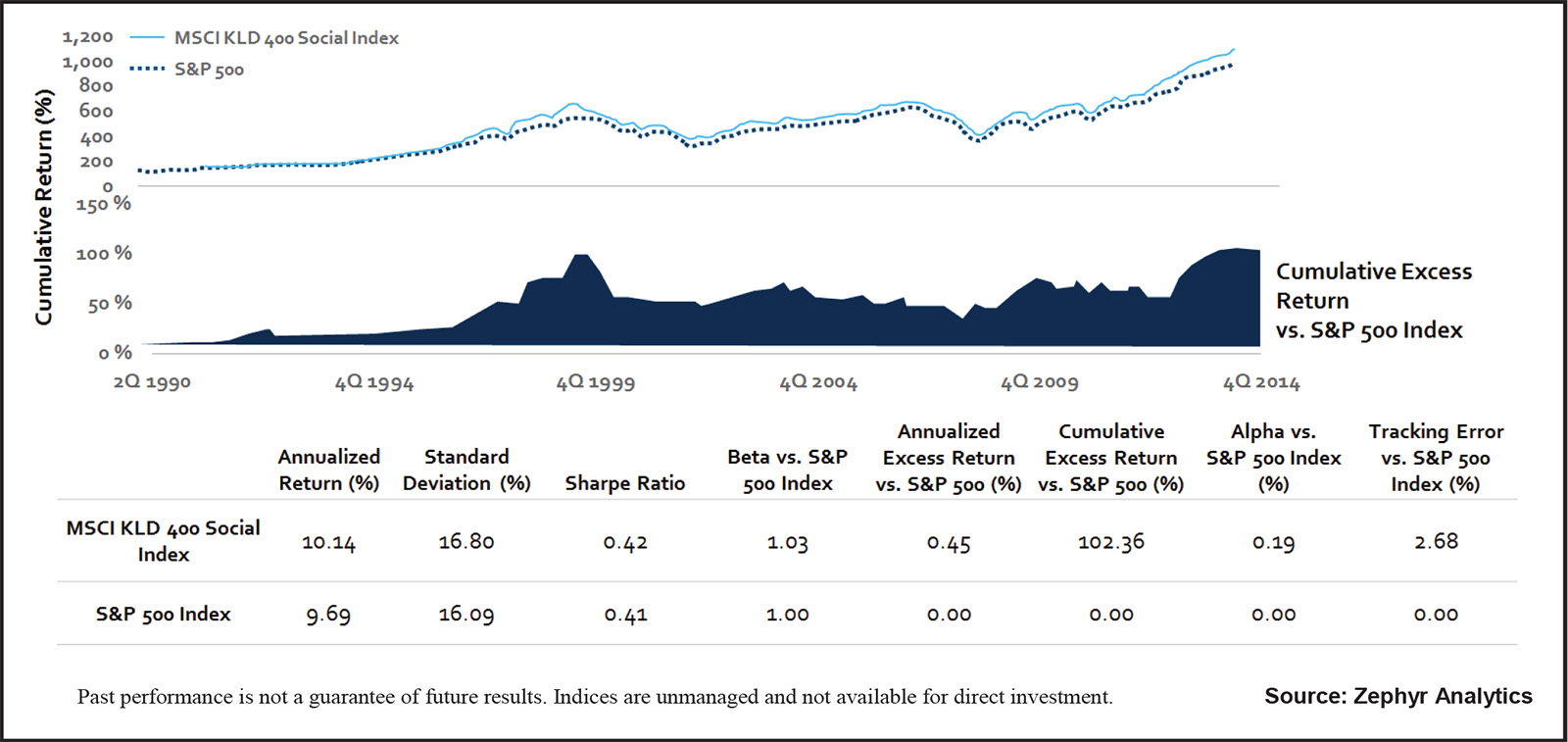

In addition, in a white paper published in 2014, TIAA-CREF selected five widely known US equity SRI indexes with track records of at least ten years—Calvert Social Index, Dow Jones Sustainability US Index (DJSI US), FTSE4Good US Index, MSCI KLD 400 Social Index, and MSCI USA IMI ESG Index—and compared their returns with two conventional US equity-based indexes, the Russell 3000 and the S&P 500. The analysis found that the SRI indexes performed competitively with the conventional indexes.

Likewise, a 2015 survey by the Morgan Stanley Institute for Sustainable Investing found that, “Benchmark performance of the MSCI KLD 400 Social Index, which includes firms meeting high Environmental, Social, and Governance (ESG) standards, has outperformed the S&P 500 on an annualized basis by 45 basis points since its inception” in 1990.

And a 2012 meta-analysis of over 100 academic studies, conducted by DB Climate Change Advisors, found that incorporating SRI results in “superior risk-adjusted returns for investors.”

Conclusion: You can do well by doing good with SRI.

This graph from the Morgan Stanley Institute for Sustainable Investing shows how the MSCI KLD 400, the world’s oldest socially responsible investment index, has outperformed the S&P 500 since its inception. Graphic by Zephyr Analytics