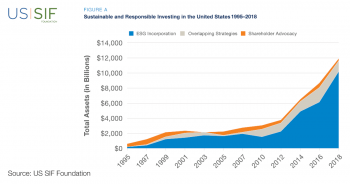

Green America’s work to promote socially responsible investing strategies, including portfolio screening on social, environmental, and corporate governance issues; community investing and banking; and shareholder action has helped drive the increase in SRI assets. The Forum for Sustainable and Responsible Investing (US SIF) reports that assets under professional management in the US have grown from $8.72 trillion in 2016 to $12 trillion in 2018.

Growth of socially responsible investing:

- Sustainable, responsible and impact investing (SRI) assets have expanded to $12.0 trillion in the United States, up 38 percent from $8.7 trillion in 2016.

- The top five issues for asset managers and their institutional investor clients are climate change/carbon, tobacco, conflict risk, human rights, and transparency and anti-corruption.

- Community investments that support low-to-moderate income communities grew from almost $122 billion in 2016 to $185 billion.

- Shareholder action continues to focus heavily on “proxy access” (the ability of shareowners to nominate corporate directors); corporate political spending; and climate issues.